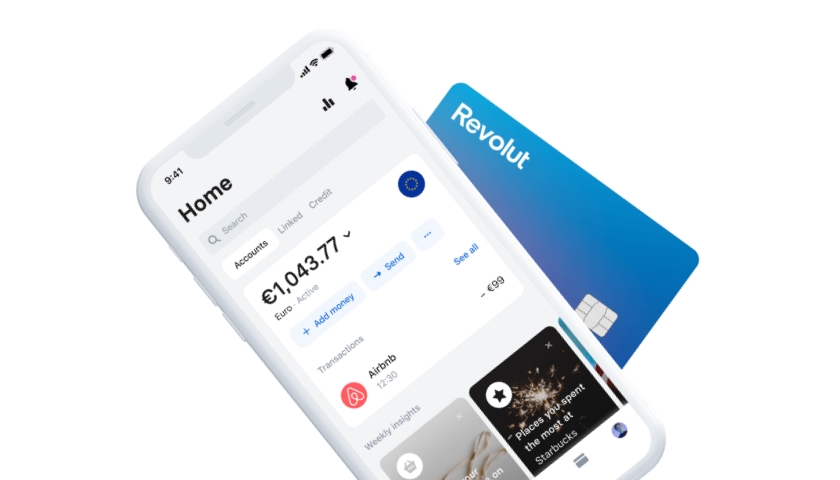

Digital banking service Revolut has today unveiled its new ‘financial super app’ that promises to “reimagine and redefine” its offering to customers.

The redesign will enable users to manage their finances all in one place, with two main sections labelled Home and Wealth.

From the Home tab, Revolut’s users will be able to access their open banking-linked accounts as well as other budgeting and analytics tools.

Through the Wealth tab, users will be able to trade stocks, cryptocurrencies and commodities.

Cryptocurrency trading has been particularly popular for Revolut’s customers, the number of users buying cryptocurrencies rose 68 per cent from 20 April to 4 May 2020, with the average amount purchased increasing by 57 per cent and the amount bought per trade increased 63 per cent.

In the coming months, Revolut plans to roll out new products and features to its now 12m strong customer base.

Back in March, the e-money institution launched Revolut Junior in the UK and Ireland to help parents teach their children about money management from as young as seven years old.

The banking service also introduced a perks feature which offers customers cashback and discounts on when they used their Revolut cards.

Revolut also introduced gold and crypto trading for both its paying and non-paying users in order to attract more customers and widen its trading portfolio.

If you needed any evidence for Revolut’s relentless international expansion, now 1 in 4 Irish adults have a Revolut card.

Despite the economic turmoil, Revolut has also set its sights on acquiring its coronavirus-hit rivals, according to founder Nikolay Storonsky, and plans to use a slice of its recent $500m Series D funding to do so.

However, Revolut has not been immune to the effects of the coronavirus crisis.

Founders Nikolay Storonsky and Vlad Yatsenko have forgone their salaries for the next twelve months as well as top executives taking a 25 per cent pay cut to ensure the digital challenger keeps its head above water.

Similarly, there has been a lot of movement at the top for Revolut as, since the beginning of lockdown, eight executives have departed the banking service, although these departures were all unrelated to coronavirus.

Source: altfi.com