The trader received a $6.28 million payday trading BONK, $9.51 million trading WIF and $7.04 million with BODEN. A memecoin trader cashed out millions in profits from several positions on meme-themed tokens in Solana. On April 26, blockchain analysis firm Lookonchain flagged the movements of a trader with the Solana Name Service account called “paulo.sol.” The crypto wallet realized profits on meme tokens like Dogwifhat (WIF), Jeo Boden (BODEN) and Bonk (BONK). The trader got into BONK as early as Nov. 11, 2023. The user noticed that the memecoin was…

Read MoreCategory: Investment

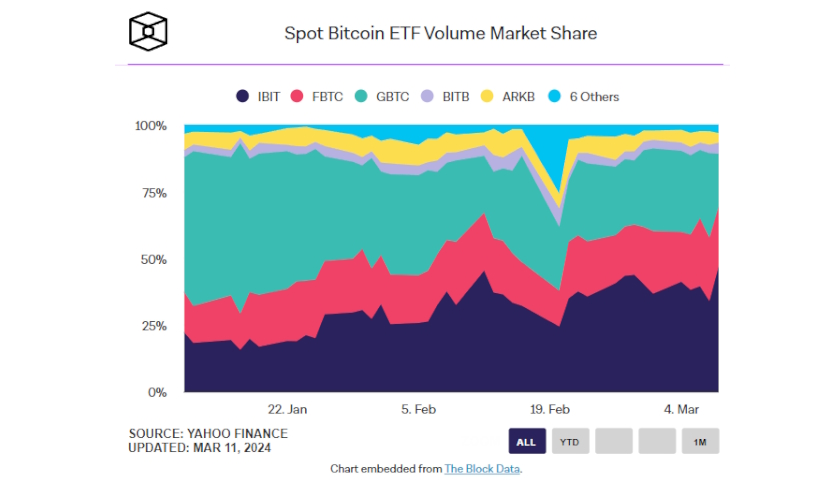

BlackRock and Fidelity’s spot bitcoin ETFs nab 69% of market share

Grayscale’s market share of cumulative spot bitcoin ETF trading volume dropped to its lowest point last Friday as rival products offered by BlackRock and Fidelity added to their assets under management. With about $30 billion already under management when its spot bitcoin ETF started trading in January, Grayscale’s fund had dominated total daily trading volume. That dominance, however, showed signs of weakening when Grayscale’s ETF closed out Friday, capturing less than 20% of the total trading volume for the first time since the new products launched. Meanwhile, BlackRock and Fidelity’s…

Read MoreMicroStrategy buys Bitcoin worth $347M to strengthen its crypto holding

On Wednesday, 28 June, MicroStrategy founder Michael Saylor revealed that the renowned firm purchased 12,333 Bitcoin between 29 April and 27 June, spending $347 million. The latest buy saw the company strengthening its crypto holding. MicroStrategy acquired its BTC assets at $28,136 average price. MicroStrategy now has 152,333 Bitcoins, worth more than $4.6B at prevailing prices. The firm is among the largest BTC hodlers. Moreover, MicroStrategy has remained resilient despite challenges plaguing the crypto space. While Michael Saylor has been supporting the leading crypto, even backing BTC’s layer2 platform Lightning…

Read MoreCoinbase Stocks Rise Following $100M Settlement With US Regulators

Cryptocurrency exchange Coinbase reached an agreement to pay a $50 million penalty to New York state’s Department of Financial Services to settle accusations that it enabled customers to open accounts without conducting necessary background checks. The regulator stated that Coinbase violated the New York Banking Law and the New York State Department of Financial Services (DFS) virtual currency, money transmitter, transaction monitoring, and cybersecurity regulations. As per the settlement, the crypto exchange is also required to invest $50 million into its compliance program over the next two years. The $100…

Read More52% of Dogecoin Addresses Remain in Profit Despite Recent Price Drop

A total of 52% of Dogecoin addresses are “in profit’’ on their investments at a current price of $0.06, according to data from IntoTheBlock. This comes despite the fact that Dogecoin remains down nearly 90% from its May 2021 peak of around $0.73. IntoTheBlock’s In/Out of the Money gives the percentage of addresses that are profiting (in the money), breaking even (at the money), or losing money (out of the money) on their positions at the current price. The In/Out of the Money indicators also look at unrealized profits and…

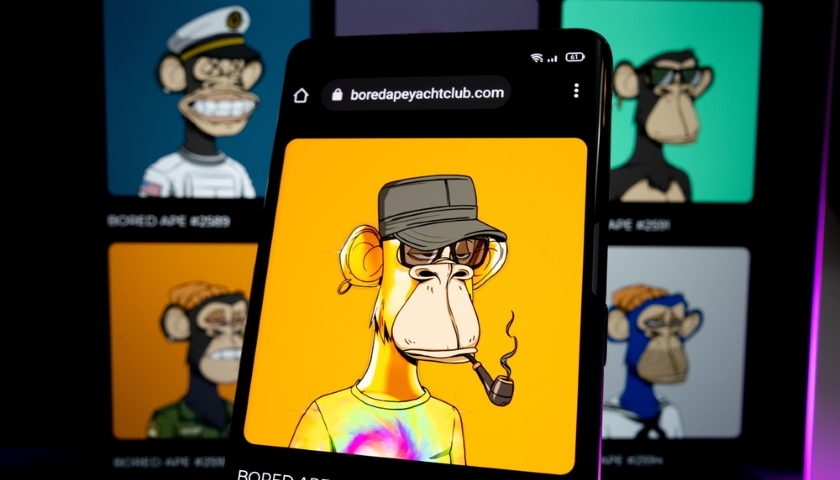

Read MoreBored Ape NFT Floor Price Falls to $88,155 as ETH’s Value Takes a Battering

The floor price of major non-fungible tokens has fallen substantially as the crypto winter worsens. This metric illustrates how much the cheapest NFT in a collection currently costs. Data from NFT Price Floor shows the least expensive Bored Ape now costs 78.5 ETH. At current rates, that’s worth just $88,155 — a painful retracement considering all these NFTs have commanded six-figure price tags for the best part of a year. Bored Ape holders have suffered a double whammy. Not only has their value in ETH plunged as the bear market…

Read MoreCryptocurrency Market Wipes Out $2 Trillion in Value Since November Peak

The cryptocurrency industry has wiped out about $2 trillion in value since hitting a $2.9 trillion peak in November 2021. All of the major digital tokens are deep in the red this year. Bitcoin has slumped more than 53 percent to around $22,000. Ethereum has lost 68 percent to about $1,200. Cardano has plunged 65 percent to below 50 cents. Dogecoin has collapsed 68 percent to roughly a nickel. Litecoin has cratered nearly 70 percent to under $50. Bitcoin and its crypto peers could be leading the financial markets lower,…

Read MoreMadonna teams up with Beeple on new exclusive NFT collection

In March 2021, Beeple made headlines after his NFT collection sold for a whopping $69.3 million. While it may seem like the digital artist went silent after the phenomenal sale, Beeple has actually been working behind the scenes on a number of new collections, including a new project with Madonna. Beeple and pop singer Madonna have been working on a new NFT project called “Mother of Creation.” The collection, which will be live in 24 hours, has been in the works for one year. Mother of Creation showcases three distinct…

Read MoreCoinbase is planning to purchase crypto exchange BtcTurk in $3.2B deal

Major United States-based cryptocurrency exchange Coinbase is reportedly planning to purchase BtcTurk for $3.2 billion. According to Turkish tech media outlet Webrazzi, which cited a Thursday report from Mergermarket, the two exchanges negotiated a price based on the market behavior of the Turkish lira and Bitcoin (BTC), arriving at roughly $3.2 billion. One or both of the two firms have reportedly already signed a term sheet. The potential acquisition would follow Coinbase CEO Brian Armstrong announcing plans to expand to every country in which the exchange can legally operate. Cointelegraph…

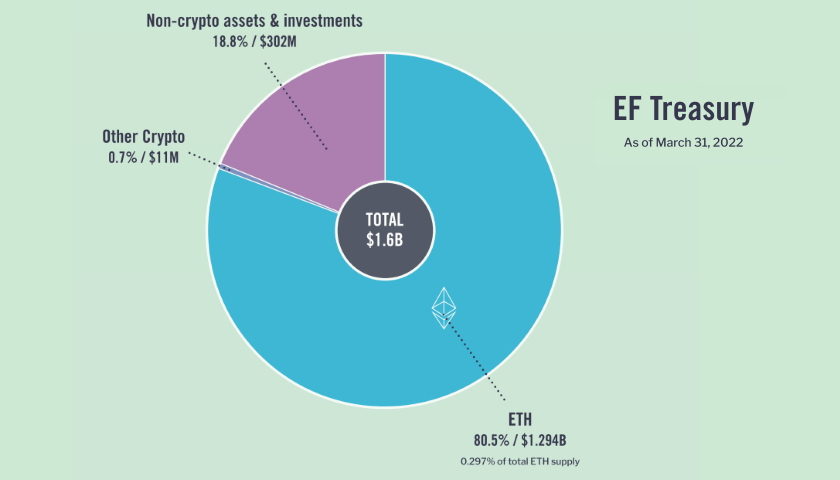

Read MoreEthereum Foundation treasury expands non-crypto assets to 19%

The Ethereum Foundation (EF) has released a report detailing how its $1.6 billion treasury consists mostly of Ether (ETH), but with a surprising 18.8% in non-crypto assets. In total, the EF non-profit organization which manages the funds for Ethereum developments holds about 0.3% of the current total ETH supply, amounting to roughly $1.3 billion which is verifiable on Etherscan. However, its non-crypto holdings account for a sizable $302 million share. The April 2022 report is the first issued by the Foundation to outline what it holds in the treasury and…

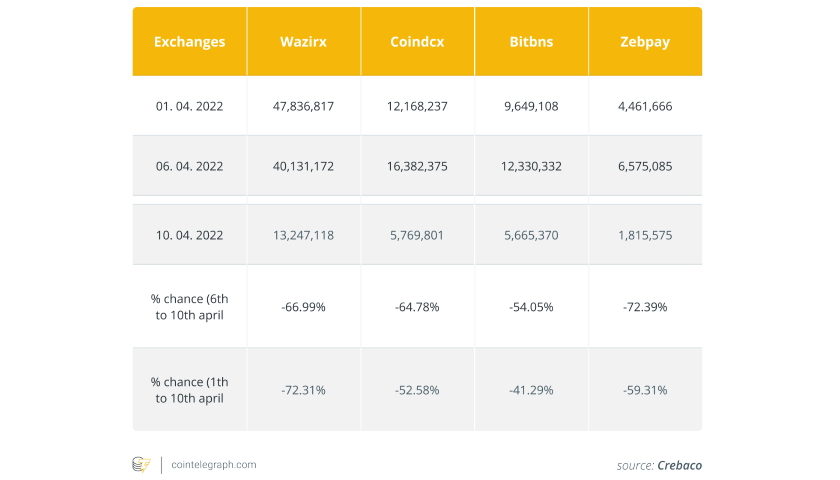

Read MoreIndian crypto exchanges’ volume plunges as 30% tax goes into effect

Payment services providers have also cut ties with major crypto exchanges despite having the same rate for gambling and fantasy sports platforms. Fresh data on Indian crypto exchanges’ trading volume reveals a significant decline in trading practices among Indians just ten days after the tax rule implementation. India’s new 30% crypto tax rule came into effect on April 1, despite many stakeholders and exchange operators warning against its ill effects. A research data report shared by Indian blockchain analytic firm Crebaco with Cointelegraph shows that trading volume on top Indian…

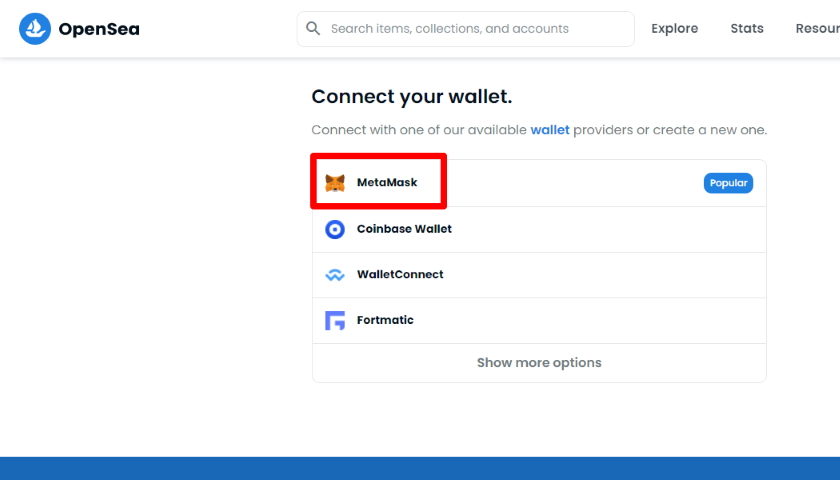

Read MoreHow to Connect OpenSea to MetaMask

OpenSea NFT is the largest non-fungible token (NFT) marketplace in the world that supports Ethereum and Polygon blockchains. Often called the eBay of NFTs, OpenSea allows you to create and sell your own NFTs on their decentralized platform as well as discover new ones to add to your collection. Founded in 2017, OpenSea typically handles between $30M to $100M a day in volume. You may be confused about what exactly an NFT is in the first place. NFTs are digitally unique files that memorialize art, video, objects, documents, and other…

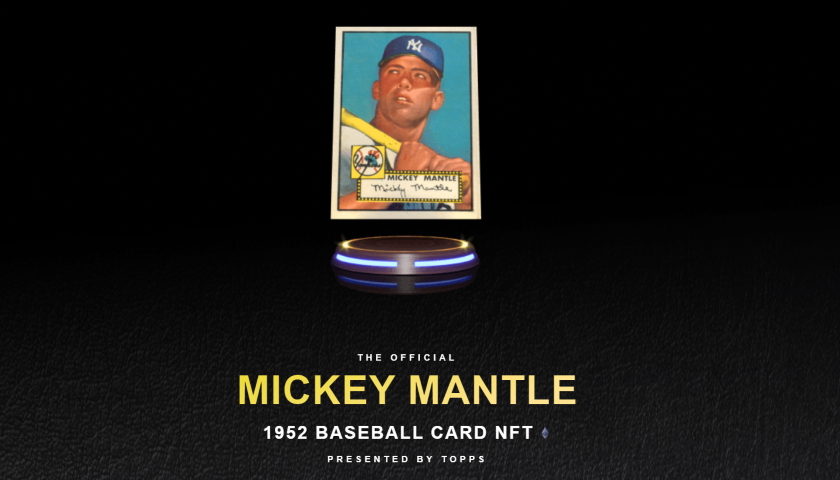

Read MoreCompany auctions 1-of-1 Topps 1952 Mickey Mantle Card NFT in what may be the highest valued sports NFT to date

History was made when the Topps trading card of American baseball player Mickey Mantle sold for $5.2 million. Setting a new standard for rare collectibles, traditional collectors quickly realized that this industry is far different from the days of older generations, with larger-ticket sales now commonplace. Now, the world is quickly shifting into a digital era, meaning physical assets that once held millions in value are making their way to the virtual world through nonfungible tokens (NFTs). The result is that NFTs are now being offered as the next generation…

Read MoreBinance invests $200M in Forbes to boost consumer knowledge on Bitcoin

Binance, the world’s largest cryptocurrency exchange by trading volumes, is making a strategic investment in the 104-year old magazine Forbes to improve consumer understanding of cryptocurrencies and blockchain. Forbes and Magnum Opus Acquisition Limited, a publicly-traded special purpose acquisition company (SPAC), officially announced Thursday securing a $200 million strategic investment from Binance. Forbes previously announced plans to go public through a business combination with Magnum Opus in August 2021, with the deal expected to close in Q1 of 2022. Binance’s strategic investment will be through Binance’s assumption of subscription agreements…

Read More2.5 Billion SHIB Burned Since Dec. 1

According to data provided by the @worldofao Twitter account, since Dec. 1, various members of the SHIB Army have removed two and a half billion SHIB tokens from circulation. Almost half a million of that astounding amount was destroyed last week. Every time large amounts of SHIB are burned, the community expects the token to begin rising in price. Another huge factor that is expected to push the SHIB price up is its potential listing on Robinhood. However, the popular trading app has not confirmed the listing rumors, and the…

Read More