Bitpanda and Deutsche Bank have formed a partnership aimed at facilitating real-time inbound and outbound cash payments for German crypto traders. Through this collaboration, Bitpanda users in Germany will gain the ability to conduct real-time payments on the platform. This initiative is expected to enhance transaction efficiency and security while bolstering liquidity for Bitpanda’s clientele in the region. The partnership entails Bitpanda using an application programming interface (API)-based account solution provided by Deutsche Bank, enabling access to German International Bank Account Numbers (IBANs). These IBANs are internationally recognised codes crucial…

Read MoreMinister Şimşek announces taxation on cryptocurrency income in Turkey

Türkiye’s rapid strides towards taxing cryptocurrency gains signify a pivotal shift in its economic regulation policies. Key Developments in Türkiye’s Cryptocurrency Regulation In recent days, Turkey has made significant progress in the regulation and taxation of crypto assets. Finance Minister Mehmet Şimşek delivered crucial insights on the subject during his economic presentation, suggesting that comprehensive measures are on the horizon. Major Tax Reforms Underway Finance Minister Şimşek announced that several tax exemptions, reductions, incentives, and exceptions would be revoked. He also mentioned that the tax on fund incomes would be…

Read MoreBitget Monthly Report of April 2024

April 2024 stood out significantly due to the Bitcoin Halving event and the introduction of BTC Spot ETF, which contributed to a surge in fund inflows. As the market navigated this momentum, Bitget witnessed growth in its futures trading volume, while its Bitget Wallet community eagerly anticipated the highly anticipated BWB airdrop. Furthermore, in terms of ecosystem expansion, Bitget launched PoolX and Pre-market for token listings and actively participated in events like BlockchainLife and Token2049 in Dubai. Notably, Bitget’s spot trading volume surged by over 30%, accompanied by a remarkable…

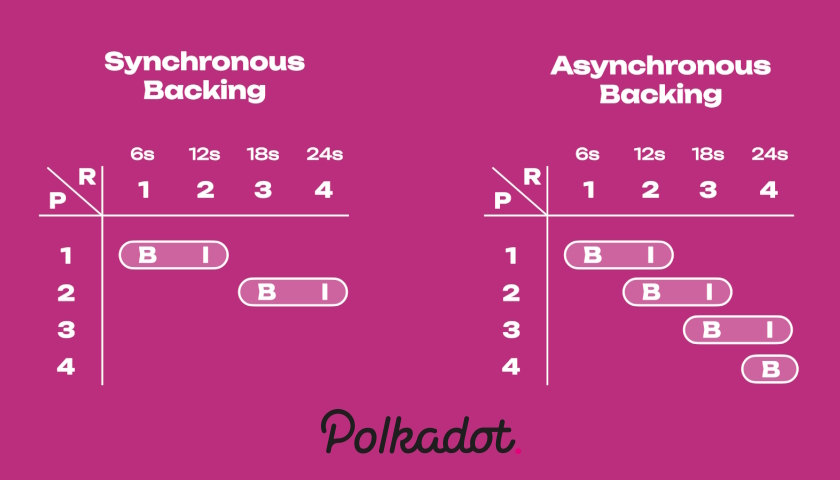

Read MorePolkadot Launches Most Important Upgrade

Polkadot is expecting to overhaul its Relay Chain protocol in the near future; however, before that happens, it has made a very important upgrade. The protocol called the latest upgrade “Asynchronous Backing,” an optimized approach for how parachain blocks are validated by the Relay Chain. How will Polkadot benefit? Upgrades on Polkadot are not new as several referendums are being voted on regularly. With Asynchronous Backing, the Relay Chain becomes 2x faster in block production. Additionally, it now becomes 3-5x more extrinsic per block, with a 6-10x boost in blockspace…

Read MoreMastercard, US Banks Test Tokenized Asset Settlement

Mastercard is collaborating with US institutions to test shared-ledger technology for settling tokenized assets like commercial bank money. In order to test shared-ledger technology with the intention of facilitating the common settlement of tokenized assets, Mastercard Inc. has embarked on a groundbreaking collaboration with some of the top institutions in the United States. Mastercard Collaborates To Test Tokenized Asset Settlement These assets include commercial bank money, Treasury-issued securities, and investment-grade debt securities. The endeavor, known as the proof-of-concept for the Regulated Settlement Network aims to replicate transactions in US dollars.…

Read MoreCrypto Venture Capital Surpasses $1 Billion Mark for Second Consecutive Month

For the second month in a row, venture capital investment in the cryptocurrency sector has exceeded $1 billion, indicating the market’s continuous expansion. April saw a total of $1.02 billion raised over 161 investment rounds, somewhat less than the previous month’s $1.09 billion from 186 deals. This achievement is a significant milestone, matching the highs achieved in October-November 2022. This accomplishment was made possible by notable fundraising efforts. Securitize, a real-world asset tokenization company, has received a $47 million investment headed by BlackRock. Monad, called the “Solana killer,” got a…

Read MoreTrader earns $23M flipping Solana memecoins

The trader received a $6.28 million payday trading BONK, $9.51 million trading WIF and $7.04 million with BODEN. A memecoin trader cashed out millions in profits from several positions on meme-themed tokens in Solana. On April 26, blockchain analysis firm Lookonchain flagged the movements of a trader with the Solana Name Service account called “paulo.sol.” The crypto wallet realized profits on meme tokens like Dogwifhat (WIF), Jeo Boden (BODEN) and Bonk (BONK). The trader got into BONK as early as Nov. 11, 2023. The user noticed that the memecoin was…

Read MoreShiba Inu Team Announces Significant Network Upgrade

Shiba Inu development team is here with exciting news in the crypto world. Accordingly, it was announced that the Shibarium network is set to undergo a transformative hard fork on May 2nd. This update aims not only to enhance the user experience but also to strengthen the expanding ecosystem of the network. Shiba Inu Team Announces Hard Fork The upcoming changes have been detailed through a series of detailed messages and an in-depth official blog post. The development team describes this upgrade as an evolutionary step for Shibarium, offering new…

Read MoreLondon Stock Exchange (LSE) To Accept Bitcoin Exchange-traded Notes (ETNs) Applications

The London Stock Exchange (LSE) released a “crypto ETN admission factsheet” showcasing its decision to accept applications for Bitcoin exchange-traded notes (ETNs). The move comes as part of the LSE’s efforts to expand its offerings and provide investors with exposure to bitcoin. Bitcoin exchange-traded notes are financial instruments that track the price of Bitcoin and are traded on traditional stock exchanges. By allowing the listing of Bitcoin ETNs, the LSE would be providing investors with an opportunity to gain exposure to BTC through regulated and familiar investment vehicles. “The proposed…

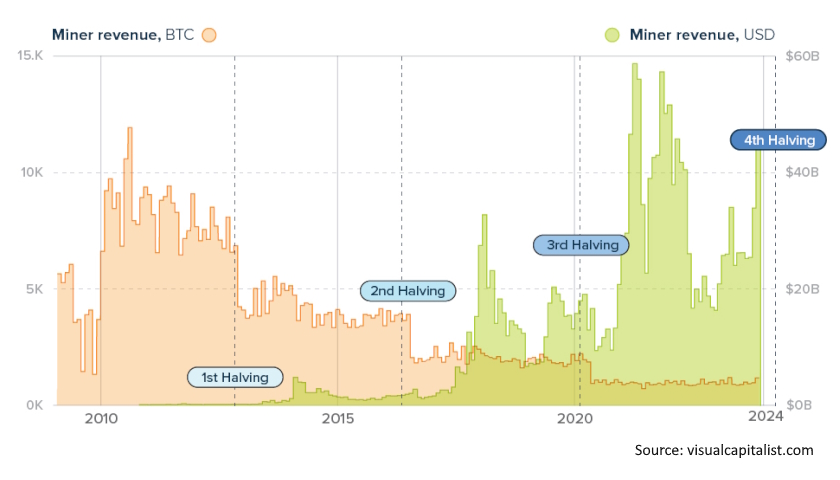

Read MoreThe 4th Bitcoin Halving Explained

Sometime in April 2024, the reward that cryptocurrency miners receive for mining bitcoin (BTC) will go from ₿6.25 to ₿3.125, with significant consequences for the world’s most valuable digital currency. To help understand this quadrennial event, we’ve teamed up with HIVE Digital to take a deep dive on historical bitcoin data from Coinmetrics to see what the three previous halvings might tell us about the fourth. Bitcoin Explained But to understand halvings, we first need to take a step back to talk a bit about how the Bitcoin network works.…

Read More