A trader has transformed an initial $12,000 investment into $1.05 million in just 10 days, primarily through the skyrocketing success of Pepe 2.0. What Happened: Data from Lookonchain shows that the trader initially allocated $90,000 to purchase 7.9 trillion Pepe 2.0 tokens, and subsequently sold 5.2 trillion of the meme coin for approximately $614,000. Pepe 2.0, a token largely introduced within the past week, positions itself as a new iteration of the popular Pepe Coin. Capitalizing on Pepe 2.0’s spike on June 28, the trader flipped $400,000 worth of Bitcoin…

Read MoreCategory: Cryptocurrency

MicroStrategy buys Bitcoin worth $347M to strengthen its crypto holding

On Wednesday, 28 June, MicroStrategy founder Michael Saylor revealed that the renowned firm purchased 12,333 Bitcoin between 29 April and 27 June, spending $347 million. The latest buy saw the company strengthening its crypto holding. MicroStrategy acquired its BTC assets at $28,136 average price. MicroStrategy now has 152,333 Bitcoins, worth more than $4.6B at prevailing prices. The firm is among the largest BTC hodlers. Moreover, MicroStrategy has remained resilient despite challenges plaguing the crypto space. While Michael Saylor has been supporting the leading crypto, even backing BTC’s layer2 platform Lightning…

Read MoreEuropean Commission outlines vision for digital euro

The European Commission on Wednesday released a proposal for a digital euro that would ensure free access to the CBDC across the bloc and establish a legal framework so that digital euro payments can be made from device to device, both online and offline. “The digital euro would be available alongside existing national and international private means of payment, such as cards or applications and it would work like a digital wallet where people and businesses could pay with the digital euro anytime and anywhere in the euro area,” the…

Read MoreTether Mints 1 Billion USDT Amid Bitcoin (BTC) Price Drop and Binance USD (BUSD) Scandal

As reported by Whale Alert, stablecoin issuer Tether has minted another billion USDT. The event came right in the midst of the Binance USD (BUSD) scandal, which the U.S. Securities and Exchange Commission is reportedly seeking to have recognized as an unregistered security. Tether’s CTO, Paolo Ardoino, was quick to announce to the public that the minting of a billion USDT is an authorized but unissued transaction. This amount will be used as inventory for issuance requests in future periods as well as chain swaps, Ardoino stressed. USDT and BUSD…

Read MoreFanatic sells 60% stake in Candy Digital amid ‘imploding NFT market’

Sports merchandise firm Fanatics is divesting its stake in nonfungible token (NFT) company Candy Digital as confidence in the asset class wanes. On Jan. 4, it was reported that Michael Rubin’s sports company Fanatics was offloading its majority 60% stake in the NFT startup. Fanatics was started in 2011 and has become a known name in sports merchandising and e-commerce, valued at $31 billion. However, the crypto bear market has hit the NFT sector hard in 2022, and Rubin’s firm is seemingly now looking to turn away from “standalone” NFT…

Read MoreDogecoin price rallies 150% in 4 days, but DOGE now most ‘overbought’ since April 2021

The Dogecoin price rally extended further on Oct. 29 in hopes that the cryptocurrency would get a major boost from Elon Musk’s Twitter acquisition. Dogecoin price jumped by nearly 75% to reach $0.146 on Oct. 29, its biggest daily gain since April 2021. Notably, the memecoin’s massive intraday rally came as a part of a broader uptrend that started earlier this week on Oct. 25. In total, DOGE’s price gained 150% during the Oct. 25-29 price rally. The surge was also accompanied by a decent increase in its daily trading…

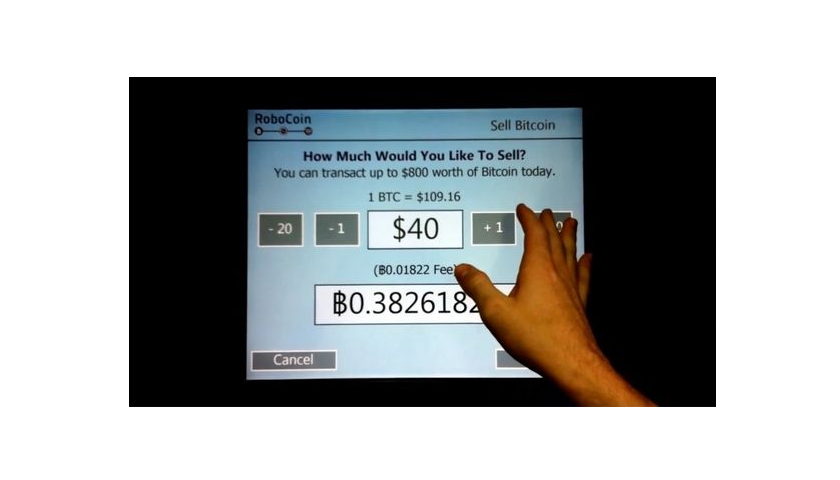

Read More9 years after the first Bitcoin ATM, there are now 38,804 globally

On Oct. 29, 2013, a coffee shop in downtown Vancouver, Canada, opened what is understood to be the world’s first publicly available Bitcoin ATM, operated by Robocoin. The crypto ATM saw 348 transactions and $100,000 transacted in its first week of operation. As of Oct. 30, 2022 — nine years and one day on — Robocoin has ceased operations and the first crypto ATM has likely been removed or replaced, but crypto ATMs have continued to increase in number with 38,804 cryptocurrency ATMs in existence today, according to Coin ATM…

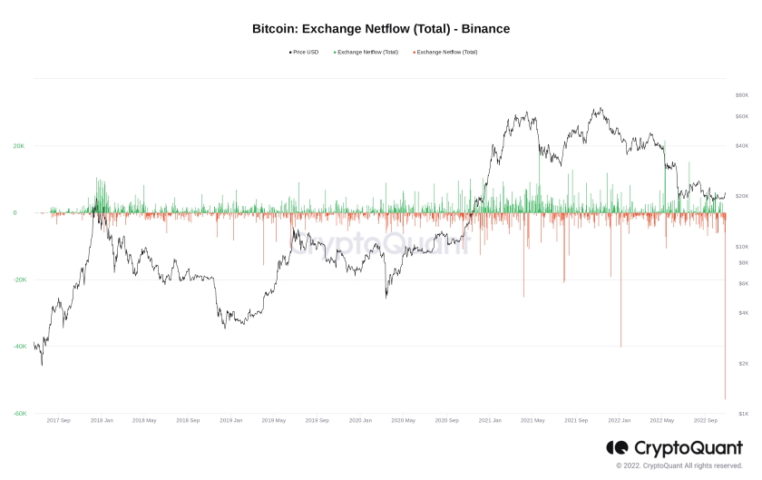

Read MoreA record 55,000 Bitcoin, or over $1.1 billion, was withdrawn from Binance

Bitcoin has seen record buying activity as BTC/USD returns to six-week highs. The latest data from on-chain analytics firm CryptoQuant shows more BTC leaving major exchange Binance in a single day than ever before. Despite warnings that a macro bottom may not yet have occurred, Bitcoin investors have wasted no time snapping up BTC above $20,000. The past two days’ gains delivered a sea change to exchange user behavior, with BTC balances dropping across the board. As the largest exchange by volume, Binance was of particular interest and saw a…

Read MoreCryptocurrency Market Wipes Out $2 Trillion in Value Since November Peak

The cryptocurrency industry has wiped out about $2 trillion in value since hitting a $2.9 trillion peak in November 2021. All of the major digital tokens are deep in the red this year. Bitcoin has slumped more than 53 percent to around $22,000. Ethereum has lost 68 percent to about $1,200. Cardano has plunged 65 percent to below 50 cents. Dogecoin has collapsed 68 percent to roughly a nickel. Litecoin has cratered nearly 70 percent to under $50. Bitcoin and its crypto peers could be leading the financial markets lower,…

Read MoreRobinhood to allow users hold their own crypto and NFTs

Robinhood is handing over the keys to some of its customers’ crypto. The trading and investing company announced Tuesday it will let users hold and custody their own cryptocurrencies and NFTs in a separate, stand-alone app. It’s the latest move in the digital asset space for Robinhood as it reaches for growth beyond stock trading. The company shares are off more than 70% since its IPO. The new app will put Robinhood squarely in competition with Coinbase and start-ups like MetaMask. Coinbase CEO Brian Armstrong called his company’s product the…

Read More