Unlike the trading volume that is an easy-to-fake metrics, as the widely circulated Bitwise report from last year found that 95% of reported volume on unregulated exchanges is “fake,” cold storage data provides a better picture.

This data comes from analysis of on-chain transfers and though not all cold wallet addresses can likely be identified with accuracy, these numbers are quite difficult to fake.

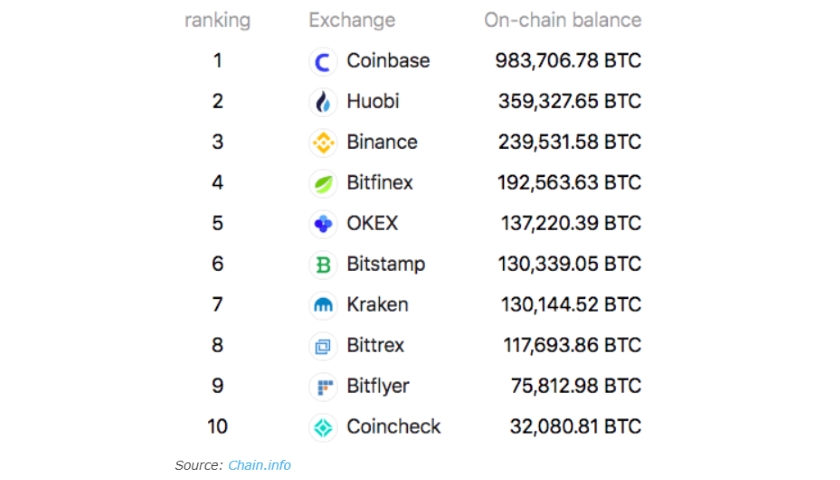

Coinbase Beats Every Exchange

Now, as per the data provided by Chain.info, Coinbase is leading among the exchanges with the largest amount of Bitcoin in their cold storage.

The US-based cryptocurrency exchange’s BTC holdings are soon going to surpass 1 million. The holdings of 983,706 BTC also come from the highest number of addresses at 2,057,510.

Coinbase’s BTC holdings grew substantially over the past year while the price first rose 160% to $13,900 in the first half of 2019 only to drop to $6,400 in the second half. Unaffected by the ups and downs in the prices, Coinbase customers continued to buy BTC at a steady pace.

This growth could be because of Coinbase’s institutional investors who are less concerned with short term price swings, unlike their retail counterparts.

Huobi Emerges at the Top

When it comes to other major exchanges, there has been a lot of upswings and downswings.

The world’s leading cryptocurrency exchange Binance maintained its second position for most of the year but has now dropped to 3rd spot. Bitfinex at the fourth spot saw a decline in the first quarter only to start recovering toward the end of 2019.

Bitstamp, Kraken, Bittrex at sixth, seventh, and eighth places had pretty flat trends in their BTC holdings.

The changes that saw substantial change in their holdings have been Huobi, Bitflyer, and OKEx, with Huobi being an exceptional and interesting case. It jumped from the fifth-largest to the second-largest exchange during last year, however, it’s BTC holdings aren’t even half of Coinbase’s holdings.

As Coin Metrics notes the $3 billion Plustoken scam, a China-based Ponzi scheme sold large quantities of BTC and ETH on Huobi in the second half of 2019. Chainalysis research also claimed that PlusToken coins can be tracked to a few OTC desks operation on the exchange.

Top Holders’ Native Tokens Surge as well

Out of these top exchanges Binance, OKEx, Huobi, Bitfinex, and Gate.io offer their native tokens. All of these exchange tokens had a good 1Q19 against BTC, recording over 100% gains. However, near the end of 2019, these gains vanished, with OKEx and Huobi being the top performers.

The fact that the cold wallet holdings and exchange token price of both Huobi and OKEx saw an increase while Bitfinex and Binance both saw a plateaued shows that there is some correlation between them.

It makes sense because more user deposits mean more trading on the exchange which turns to more revenue.

Source: bitcoinexchangeguide.com