The City of Detroit will become the largest US city to accept Bitcoin as a means of payment. In a press release, the 26th-largest city stated that Detroiters will soon be able to make payments for city-related utilities through Bitcoin. Detroit noted that it will accept tax payments and city fees using cryptocurrencies. The payment options would become available to Detroiters in mid-2025. The Thursday report revealed that Detroit partnered with financial technology giant PayPal to create a platform that would facilitate the payment option. The debut of payment options…

Read MoreAuthor: CRYPTO WORLD

Binance Labs makes first foray into DeSci sector with investment in BIO Protocol

Binance Labs, the $10 billion venture capital and incubation arm of the crypto exchange Binance, has made its first foray into the decentralized science sector with an investment in BIO Protocol. “BIO can be thought of as a Y Combinator for onchain Science,” Binance Labs explained in a statement shared with The Block. It is designed to change how early-stage scientific research is financed and commercialized using blockchain technology. The investment amount and structure were not disclosed. In addition to the investment from Binance Labs, earlier this year, BIO began…

Read MoreMetaplanet “Asia’s Microstrategy” Raises 10 Billion Yen to Boost Bitcoin Holdings

Japan’s investment firm Metaplanet has wrapped up its 11th Stock Acquisition Rights exercise period. CEO Simon Gerovich announced on X that the company achieved a 72.8% exercise rate with 13,774 individual shareholders participating. The CEO said that the unexercised rights will go to EVO FUND. EVO FUND’s exercise of the transferred rights will bring Metaplanet’s total funding to 10 billion yen. Gerovich thanked the shareholders for their support, saying: “We would like to thank all shareholders for their invaluable support and contribution, which strengthens Metaplanet’s mission of becoming a leading…

Read MoreQuantum computer ‘threat’ to crypto is exaggerated — for now

A report that Chinese researchers have employed a D-Wave quantum computer to breach encryption algorithms used to secure bank accounts, top-secret military data and crypto wallets is, at first glance, a matter of deep concern. “This is the first time that a real quantum computer has posed a real and substantial threat to multiple full-scale SPN [substitution-permutation network] structured algorithms in use today,” wrote Shanghai University scientists in a peer-reviewed paper, according to an Oct. 11 report in the South China Morning Post (SCMP). The paper talks about breaking RSA…

Read MoreEuropean investors pour record $105B into US Bitcoin ETFs

European investors have allocated a record amount of capital into spot Bitcoin exchange-traded funds (ETFs) in the United States. Europeans have invested over $105 billion in spot Bitcoin ETFs year-to-date (YTD), marking an all-time high. Growing ETF inflows could push Bitcoin to an all-time high from its current crabwalk. Inflows into US Bitcoin ETFs accounted for about 75% of the new capital that helped Bitcoin surpass $50,000 in Feb. 2024. Despite the record European inflows, Bitstamp data shows that Bitcoin has been unable to recover above the psychological level of…

Read MoreVanEck Enables Staking Options for Solana ETP

Leading digital asset manager VanEck has enabled staking options for its Solana exchange-traded note (ETN) in the European market. Matthew Sigel, VanEck’s Head of Digital Assets Research, announced the development today in a statement shared on X. According to Sigel, the staking rewards for VanEck’s Solana ETN (VSOL) will accrue and be re-invested daily. The rewards will automatically reflect in the product’s daily net asset value (NAV). Investors will benefit from the recently launched feature without having to manage the process themselves. Sigel emphasized that the company will manage the…

Read MoreTON faces an 18% drop as THESE bearish signs emerge

Toncoin [TON] has underperformed against Bitcoin [BTC] and other altcoins in the last 30 days after a 5% drop in price. At press time, TON traded at $5.28, as mild volatility hindered significant price moves. A look at the Sharpe ratio shows that holders are currently sitting at significantly low rewards. At press time, this metric was negative, and at its lowest level in one month. A negative Sharpe ratio shows that the risk of holding Toncoin is higher than the reward. With TON failing to post significant gains, a…

Read MoreBybit bags provisional crypto license from Dubai regulator

Bybit, the world’s second-largest crypto exchange by derivatives volume, has secured a provisional license in Dubai two years after setting up its headquarters in the city. The centralized crypto exchange (CEX) has received a non-operational license from the Virtual Asset Regulatory Authority (VARA), according to an announcement shared with Cointelegraph. According to Helen Liu, Bybit’s Chief Operating Officer, the new license represents a major milestone in the company’s global expansion strategy, driven by Dubai’s ambition to become a leading blockchain hub. An increasing number of crypto companies are relocating to…

Read MoreETH trader turns $87K into almost $40M after 8-year hold

Although complex trading strategies can generate significant profits for investors, a recent example from an Ether whale demonstrates that a straightforward buy-and-hold approach can also deliver impressive results. traded at around $5 per token. Back then, an investor bought 16,636 ETH on the crypto exchange ShapeShift. Chinese crypto data account EmberCN said the tokens were acquired at $5.23 per token, putting the total cost at $87,006. The blockchain analytics account said that after holding for over eight years, the account started selling some of its holdings. On Sept. 16, the…

Read MoreChinese government mulls anti-money laundering law to ‘monitor’ new fintech

Chinese lawmakers are considering revising an earlier anti-money laundering law to enhance capabilities to “monitor” and analyze money laundering risks through emerging financial technologies — including cryptocurrencies. According to a translated statement from the South China Morning Post, Legislative Affairs Commission spokesperson Wang Xiang announced the revisions on Sept. 9—citing the need to improve detection methods amid the “rapid development of new technologies.” The newly proposed legal provisions also call on the central bank and financial regulators to collaborate on guidelines to manage the risks posed by perceived money laundering…

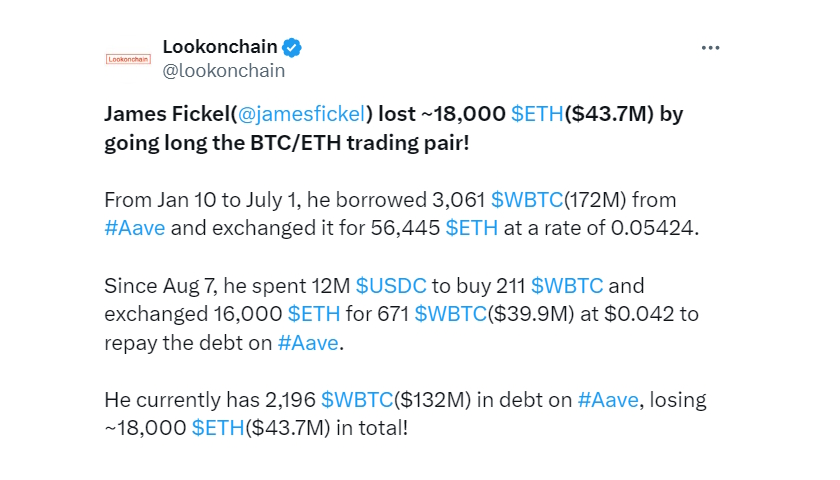

Read MoreCrypto millionaire loses $43 million in Ether-Bitcoin trading bet

Crypto millionaire James Fickel has suffered losses exceeding $43 million since Jan. 10, as his debt on the decentralized lending platform Aave surged to $132 million. Fickel, an early Ethereum investor and the founder of longevity research firm Amaranth Foundation lost over $43.7 million by essentially betting on Ether’s price. Based on the millionaire’s 2024 investments, Fickel expected Ether price to rise against Bitcoin’s when he first borrowed $172 million worth of Wrapped Bitcoin (WBTC) on Jan. 10, according to a Sept. 14 X post by Lookonchain. Since the start…

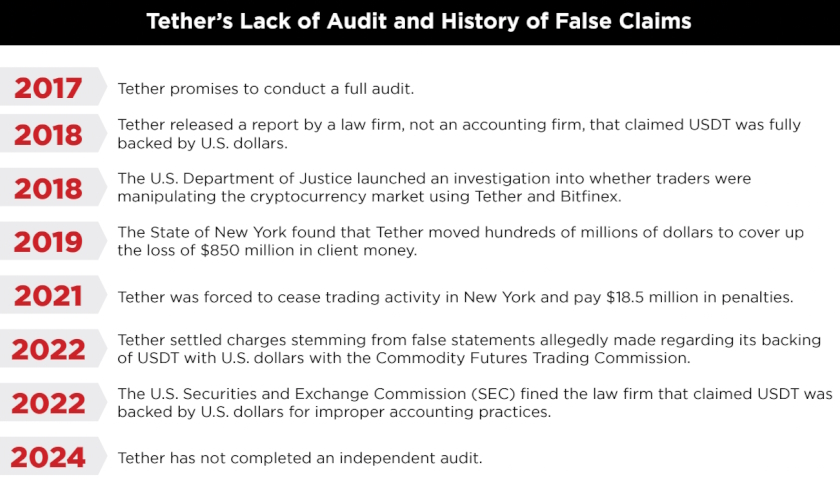

Read MoreConsumer protection watchdog warns about Tether’s reserves

onsumers’ Research, a consumer protection group, published a Sept. 12 report warning about stablecoin issuer Tether. It called the company out for a lack of transparency surrounding its US dollar reserves. The consumer protection group claimed that Tether has yet to produce a full audit of the dollar reserves purportedly backing the USDT stablecoin from a reputable accounting firm, despite numerous promises by the stablecoin issuer to audit its reserves. This lack of transparency is similar to the situation that precipitated the collapse of FTX and Alameda Research, the authors of the Consumers’…

Read MoreRussian officials approve use of crypto for cross-border payments

The Bank of Russia and the country’s Ministry of Finance have reportedly reached an agreement allowing cross-border settlements in cryptocurrencies. According to a Thursday report from the Russia-based publication Kommersant, Russia’s Deputy Finance Minister Alexei Moiseev said the government department has agreed “on the whole” with the central bank over a rule that would let residents send cross-border payments using cryptocurrencies. The proposed policy change was reportedly aimed at allowing Russian nationals access to digital wallets. “[The policy] generally describes how to acquire cryptocurrency, what can be done with it,…

Read MoreDeutsche Bank partners with Bitpanda

Bitpanda and Deutsche Bank have formed a partnership aimed at facilitating real-time inbound and outbound cash payments for German crypto traders. Through this collaboration, Bitpanda users in Germany will gain the ability to conduct real-time payments on the platform. This initiative is expected to enhance transaction efficiency and security while bolstering liquidity for Bitpanda’s clientele in the region. The partnership entails Bitpanda using an application programming interface (API)-based account solution provided by Deutsche Bank, enabling access to German International Bank Account Numbers (IBANs). These IBANs are internationally recognised codes crucial…

Read MoreMinister Şimşek announces taxation on cryptocurrency income in Turkey

Türkiye’s rapid strides towards taxing cryptocurrency gains signify a pivotal shift in its economic regulation policies. Key Developments in Türkiye’s Cryptocurrency Regulation In recent days, Turkey has made significant progress in the regulation and taxation of crypto assets. Finance Minister Mehmet Şimşek delivered crucial insights on the subject during his economic presentation, suggesting that comprehensive measures are on the horizon. Major Tax Reforms Underway Finance Minister Şimşek announced that several tax exemptions, reductions, incentives, and exceptions would be revoked. He also mentioned that the tax on fund incomes would be…

Read More