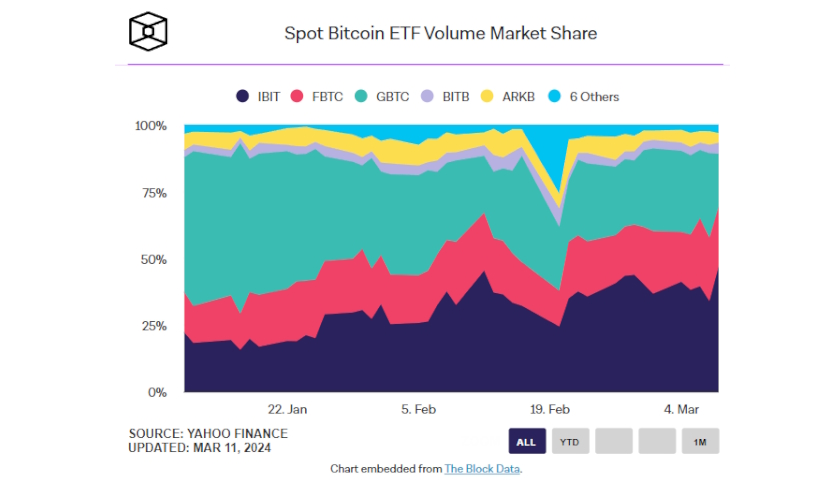

Grayscale’s market share of cumulative spot bitcoin ETF trading volume dropped to its lowest point last Friday as rival products offered by BlackRock and Fidelity added to their assets under management.

With about $30 billion already under management when its spot bitcoin ETF started trading in January, Grayscale’s fund had dominated total daily trading volume. That dominance, however, showed signs of weakening when Grayscale’s ETF closed out Friday, capturing less than 20% of the total trading volume for the first time since the new products launched.

Meanwhile, BlackRock and Fidelity’s ETFs combined for 69% of the total trading volume seen on Friday, according to The Block’s Data Dashboard. When spot bitcoin ETFs started trading in January, Grayscale’s product — a conversion of its flagship GBTC fund — consistently absorbed roughly half of all trading activity, the dashboard also said.

BlackRock’s spot bitcoin ETF made up nearly 47% of all trading volume on Friday. Simultaneously, BlackRock and Fidelity’s products combined held almost 80% of the cumulative assets under management for all spot bitcoin ETFs, excluding Grayscale, also according to The Block Data Dashboard.

Read more: theblock.co